Math income tax brackets answer key delves into the intricate world of taxation, providing a roadmap to understanding the complex calculations that determine our tax liability. This comprehensive guide unravels the intricacies of income tax brackets, empowering individuals and businesses to navigate the financial landscape with confidence.

Income tax brackets establish a progressive tax system, where higher earners contribute a larger proportion of their income towards taxes. This system aims to distribute the tax burden equitably and support essential public services.

Income Tax Brackets

Income tax brackets refer to the different ranges of taxable income, each of which is subject to a specific tax rate. The purpose of using income tax brackets is to create a progressive tax system, where individuals with higher incomes pay a higher proportion of their income in taxes.

For example, in a tax system with three income tax brackets, the first bracket could cover incomes up to $50,000 and be subject to a tax rate of 10%. The second bracket could cover incomes between $50,000 and $100,000 and be subject to a tax rate of 15%. The third bracket could cover incomes over $100,000 and be subject to a tax rate of 20%. Under this system, an individual earning $40,000 would pay 10% tax on their entire income, while an individual earning $120,000 would pay 10% tax on the first $50,000 of their income, 15% tax on the next $50,000, and 20% tax on the remaining $20,000.

Benefits of Using Income Tax Brackets

- Fairness and equity:Income tax brackets ensure that individuals with higher incomes contribute a larger share of taxes, promoting fairness and equity in the tax system.

- Economic growth:By reducing the tax burden on lower-income earners, income tax brackets can stimulate economic growth by increasing disposable income and consumer spending.

- Simplicity:Income tax brackets simplify the tax filing process by providing clear and straightforward rules for calculating tax liability.

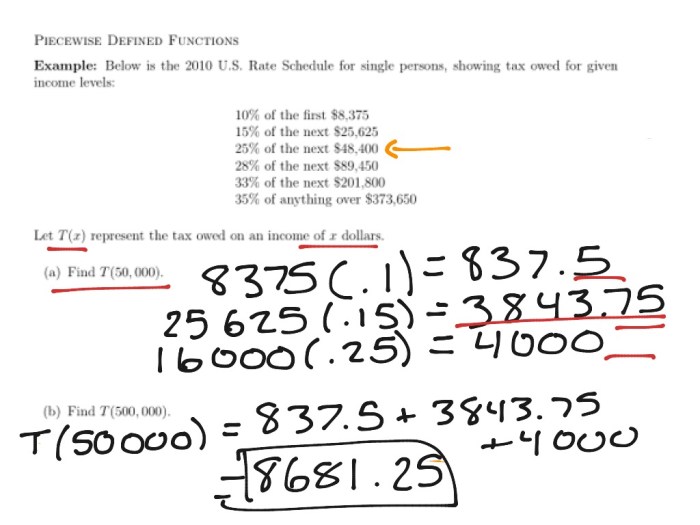

Math Involved in Income Tax Brackets: Math Income Tax Brackets Answer Key

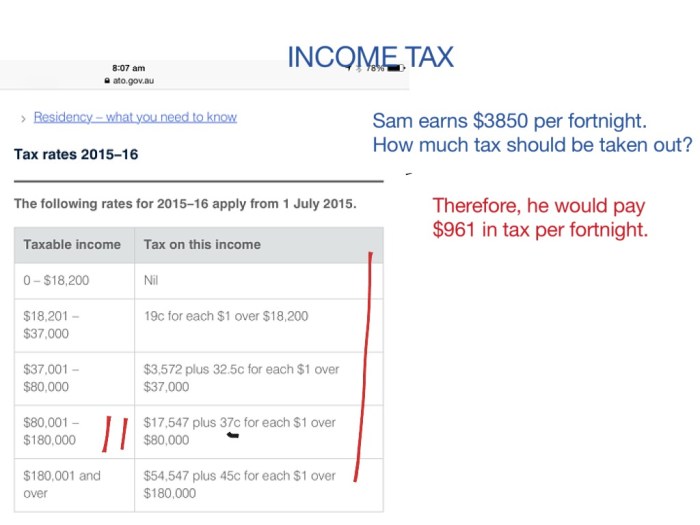

Calculating tax liability within each income tax bracket involves mathematical operations that determine the amount of tax owed based on the taxable income and the applicable tax rate.

Tax Calculation Formula

The general formula for calculating tax liability within a tax bracket is:

Tax Liability = Taxable Income x Marginal Tax Rate

Where:

- Taxable Income is the amount of income subject to taxation within the specific bracket.

- Marginal Tax Rate is the percentage of tax applied to the taxable income within the bracket.

Example

For example, consider an individual with a taxable income of $50,000. The applicable tax bracket is 25%, which means the marginal tax rate is 0.25.

Using the formula:

Tax Liability = $50,000 x 0.25 = $12,500

Therefore, the individual’s tax liability within the 25% tax bracket is $12,500.

Impact of Marginal Tax Rate

The marginal tax rate plays a crucial role in determining the tax liability. As the taxable income increases within a bracket, the marginal tax rate remains constant, resulting in a proportional increase in tax liability.

This means that individuals with higher taxable incomes within a bracket pay a higher proportion of their income in taxes compared to those with lower taxable incomes within the same bracket.

Impact of Income Tax Brackets

Income tax brackets have a significant impact on individuals and businesses. They influence financial planning, investment decisions, and the disposable income available to taxpayers.

Impact on Individuals, Math income tax brackets answer key

For individuals, income tax brackets determine the amount of tax they owe on their earnings. Higher income earners typically pay a higher percentage of their income in taxes due to the progressive nature of the tax system. This can impact their disposable income and financial planning decisions.

For example, a taxpayer earning $50,000 may be in a lower tax bracket than a taxpayer earning $100,000. As a result, the taxpayer earning $50,000 will pay a smaller percentage of their income in taxes, leaving them with more disposable income.

Impact on Businesses

For businesses, income tax brackets can affect profitability and investment decisions. Businesses may choose to structure their operations to minimize their tax liability by utilizing tax deductions, credits, and other tax-saving strategies.

For example, a business may choose to invest in capital equipment that qualifies for tax depreciation deductions. By reducing their taxable income, they can reduce their overall tax liability and increase their profitability.

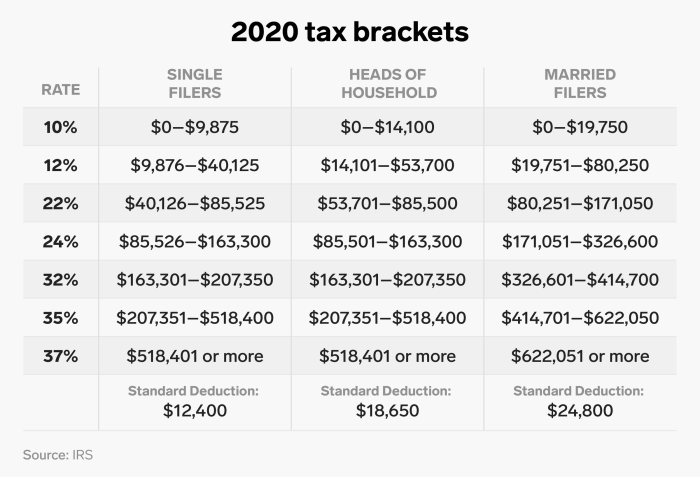

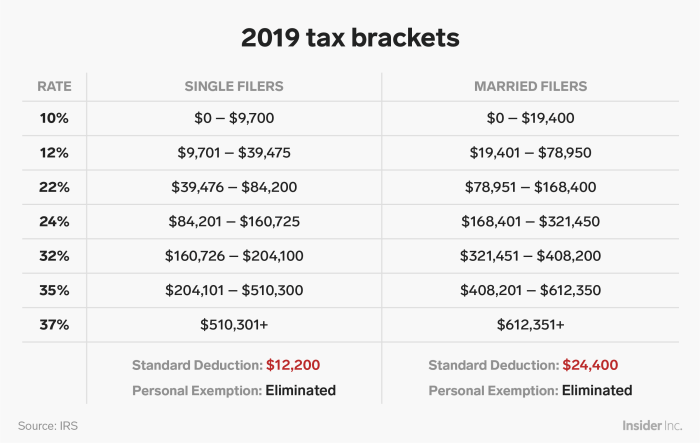

Comparison of Income Tax Brackets

Income tax brackets vary across countries and regions, resulting in different tax burdens for individuals and businesses. Understanding these variations is crucial for financial planning and policy analysis.

The following table compares income tax brackets in three countries:

| Country | Tax Bracket | Tax Rate |

|---|---|---|

| United States | Up to $10,275 | 10% |

$10,276

|

12% | |

$41,776

|

22% | |

| United Kingdom | Up to £12,570 | 0% |

£12,571

|

20% | |

£50,271

|

40% | |

| Canada | Up to $50,197 | 15% |

$50,198

|

20.5% | |

$100,393

|

26% |

Similarities and Differences

The table reveals similarities and differences in income tax brackets across the three countries.

- All three countries have a progressive tax system, where higher income earners pay a higher percentage of their income in taxes.

- The United States and Canada have a wider range of tax brackets compared to the United Kingdom.

- The United Kingdom has a higher tax-free allowance compared to the United States and Canada.

Implications

The differences in income tax brackets have significant implications for individuals and businesses:

- Individuals with higher incomes in countries with higher tax rates will have a greater proportion of their income deducted for taxes.

- Businesses operating in countries with lower tax rates may have a competitive advantage in terms of labor costs.

- Governments use tax brackets to distribute the tax burden and fund public services.

Historical Evolution of Income Tax Brackets

The concept of income tax brackets has undergone significant evolution since its inception. Initially introduced as a means of equitably distributing the tax burden, income tax brackets have been shaped by various historical events, economic policies, and societal changes.

Early Origins

The origins of income tax brackets can be traced back to the late 18th century. In 1799, Great Britain implemented the first modern income tax, which employed a progressive bracket system. This system divided taxpayers into different brackets based on their income levels, with higher earners paying a higher percentage of their income in taxes.

Industrial Revolution and Economic Growth

The Industrial Revolution and subsequent economic growth in the 19th century led to a substantial increase in national wealth. This, in turn, fueled the need for increased government revenue to support public infrastructure, education, and other social programs. As a result, income tax brackets were adjusted to generate higher tax revenue from wealthy individuals and corporations.

Social and Political Factors

Social and political movements also played a role in shaping income tax brackets. The rise of labor unions and the growing demand for social justice led to the implementation of more progressive tax systems. These systems featured higher tax rates for the highest earners and lower rates for low- and middle-income earners.

War and Economic Crises

Major historical events, such as wars and economic crises, have also influenced the evolution of income tax brackets. During wartime, governments often increase tax rates to fund military expenditures. Economic crises, on the other hand, may lead to tax cuts or bracket adjustments to stimulate economic growth.

Recent Trends

In recent decades, there has been a global trend towards simplifying income tax brackets. Many countries have reduced the number of brackets and widened the income ranges within each bracket. This simplification aims to make tax systems more transparent and reduce compliance costs for taxpayers.

Controversies and Debates

Income tax brackets have been a subject of ongoing controversies and debates. These discussions center around the fairness, efficiency, and effectiveness of the current system, as well as proposals for potential reforms.

One of the main debates is whether the current system is fair. Critics argue that the progressive nature of the brackets, where higher earners pay a higher percentage of their income in taxes, places an unfair burden on the wealthy.

Proponents, on the other hand, contend that this structure is necessary to ensure that everyone contributes their fair share to the government’s revenue.

Arguments for the Current System

- Fairness:Progressive tax brackets ensure that those who can afford to pay more contribute a larger proportion of their income to the government, which can be used to fund essential public services.

- Revenue generation:The current system generates a significant portion of government revenue, which is crucial for funding public programs and infrastructure.

- Economic growth:Some argue that progressive tax brackets can promote economic growth by stimulating consumption and investment among lower-income earners.

Arguments Against the Current System

- Unfairness:Critics argue that the current system is unfair to high earners, as they pay a disproportionately high share of taxes.

- Disincentive to work:Progressive tax brackets can create a disincentive to work for higher earners, as they may feel that they are not adequately compensated for their additional efforts.

- Complexity:The current system is complex and can be difficult to understand, leading to potential errors and tax avoidance.

Proposals for Reform

Various proposals have been put forward to reform income tax brackets. These include:

- Flat tax:A flat tax system would impose a single tax rate on all income levels, eliminating the progressive nature of the current system.

- Consumption tax:A consumption tax would shift the tax burden from income to spending, potentially reducing the disincentive to work.

- Negative income tax:A negative income tax system would provide a tax credit to low-income earners, effectively reducing their tax liability.

The debate over income tax brackets is likely to continue, as there is no clear consensus on the best approach to taxation. The current system has both supporters and detractors, and any potential reforms will need to carefully consider the trade-offs between fairness, efficiency, and revenue generation.

Commonly Asked Questions

What are income tax brackets?

Income tax brackets are ranges of taxable income that are subject to different tax rates.

How do I calculate my tax liability?

Your tax liability is determined by applying the appropriate tax rate to your taxable income within each bracket.

What is the marginal tax rate?

The marginal tax rate is the tax rate applied to the last dollar of taxable income earned.